One of the most common user questions I see on the Facebook and Twitter streams for Apache OpenOffice is “Do you have a iPad version?” or “Do you have a tablet version”? Although there are companies that offer access to OpenOffice via a virtualized remote session, there is no native tablet version of OpenOffice.

I have received questions, behind the scenes, about the feasibility of starting such an effort at Apache. Of course, creating a tablet version of OpenOffice, a competitive application with a first-class native touch UI, with platform integration and optimization, is a non-trivial effort. My impression is that there are several companies, small and large, that would find this to be an intriguing possibility. But the task is too large to do it alone. But with several companies involved, as a joint effort, in an open source project, then this becomes possible.

Imagine if we had such an open source tablet version of OpenOffice available today. It would be an app that everyone would want. If done right the OpenOffice app would be at the top of the charts just as the desktop OpenOffice is one of the leading open source desktop apps. The app itself would be free, of course. But it would be an open platform that we could all build upon.

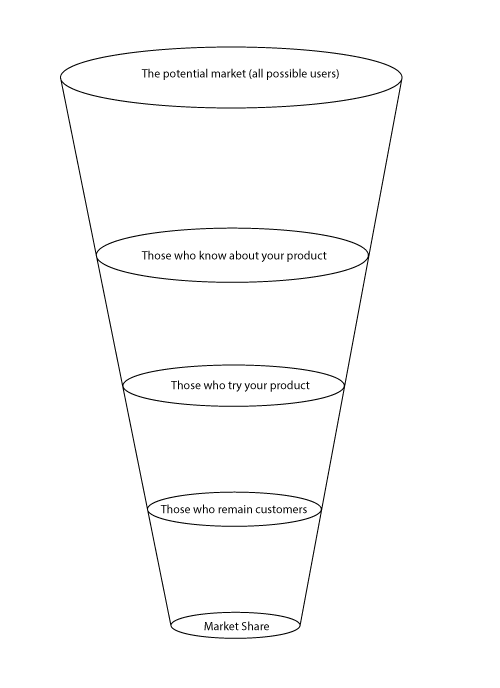

Possible business models might include:

- Cloud services related to documents, range from storage to sharing and collaboration

- Extensions to the app, in-app purchases of additional templates, content, etc.

- Advertising-supported apps.

- From service provider perspective, avoidance of licensing fees for competing commercial office software.

- A “white label” version that can be rebranded per customer

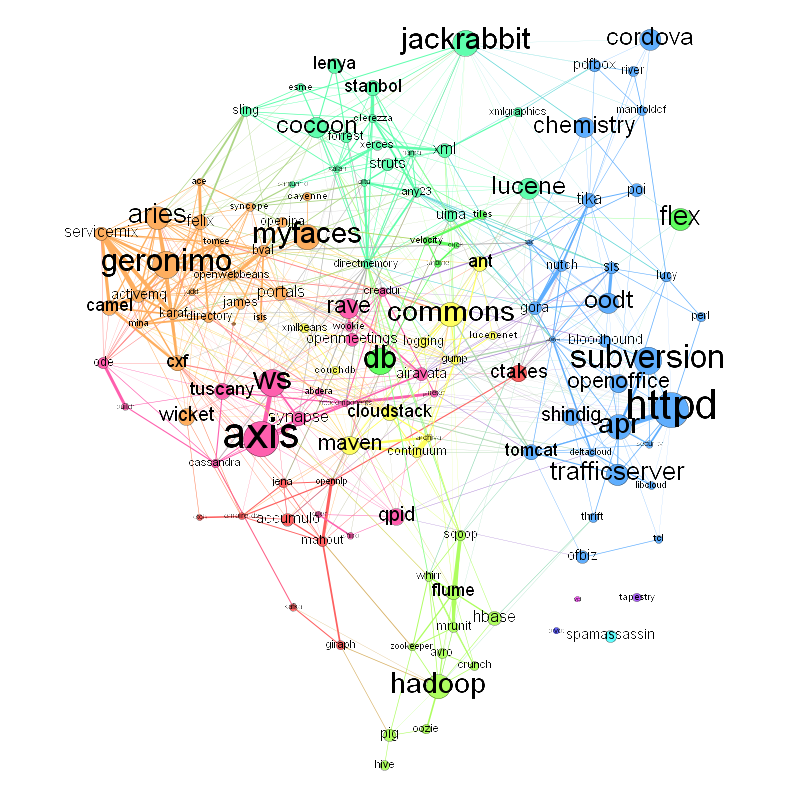

There are good reasons, I think, for doing such work at Apache, including:

- Existing expertise in the OpenOffice product

- Proven community development culture based on The Apache Way

- Permissive, commercially-friendly Apache License, the preferred license for Android userspace

- Strong brand / name recognition

I’d like to have a discussion with those having a serious interest in making a tablet version of OpenOffice. By serious, I mean those who might be willing to contribute developers to a larger effort, if such an effort were to materialize. I’m happy to talk one-on-one. And if there is sufficient serious interest from multiple parties I can broker a meeting of interested parties to discuss further options.

If any of this sounds interesting and you want to register your interest please send me an email at robert_weir@us.ibm.com.