Last year I did a three-part blog (“The Power of Brand and the Power of Product”) describing a simple model of product adoption and market share, and showed how the parameters of that model could be determined using a single survey question. I used the open source productivity suites, OpenOffice and LibreOffice, as examples. It is now time to update that analysis with the most-recent survey data. (If you want to look up the original posts, here are the links: part one, part two, part three).

To recap the methodology, I conducted a survey using Google’s Consumer Survey service, which uses sampling and post-stratification weighting to match the target population, which in this case was the U.S. internet population. In other words, the survey is weighted to reflect the population demographics, for age, sex, region of the country, urban versus rural, income, etc.

The question in the survey was:

What is your familiarity with the software application called “OpenOffice”?

- I have never heard of it

- I am aware of it but have never used it

- I have tried it once

- I use it only sometimes

- I use it on a regular basis

With 1502 responses, the results were:

| I have never heard of it | 61.3% |

| I am aware of it but have never used it | 13.3% |

| I have tried it once | 7.6% |

| I use it only sometimes | 10.3% |

| I use it on a regular basis | 7.5% |

The same question was asked about LibreOffice, with results:

| I have never heard of it | 82.3% |

| I am aware of it but have never used it | 5.8% |

| I have tried it once | 4.4% |

| I use it only sometimes | 3.1% |

| I use it on a regular basis | 4.3% |

Now these numbers are somewhat interesting on their own, but what is far more interesting are the derived metrics, which look at things like:

- What is the name recognition of the product?

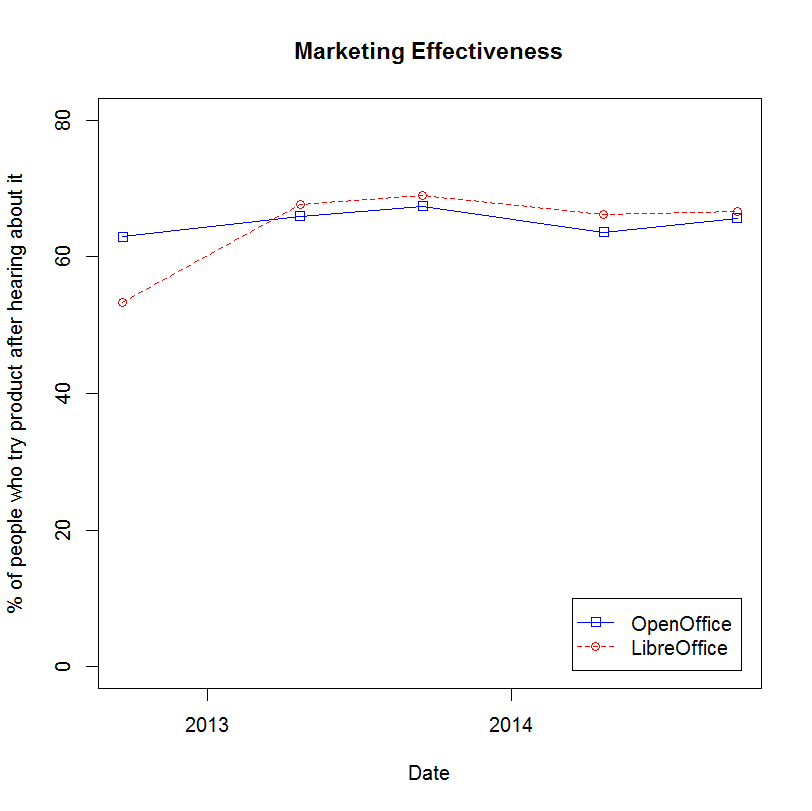

- Of those who have heard of the product, what percentage actually give it a try? This is a measure of marketing effectiveness.

- Of those who have tried the product, what percentage actually continue to use it? This is a measure of user satisfaction.

- What percentage of all respondents use the product? This is a measure of market share.

Full details on how these other metrics are calculated, from this single survey question, can be found in Part One of this series.

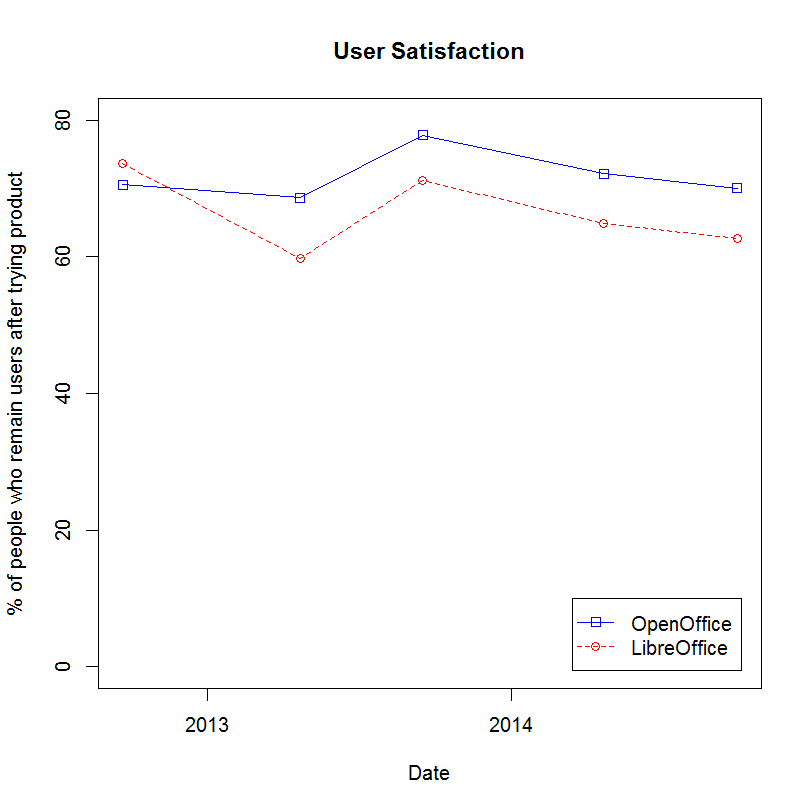

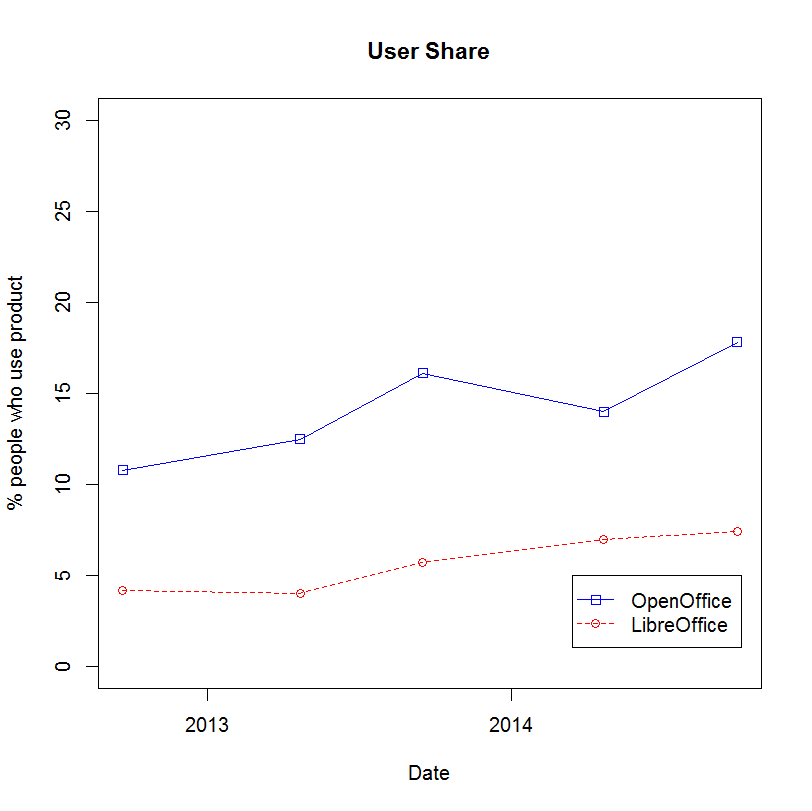

Here are some charts to show how these metrics have evolved over the 2 1/2 years I’ve worked with this survey approach:

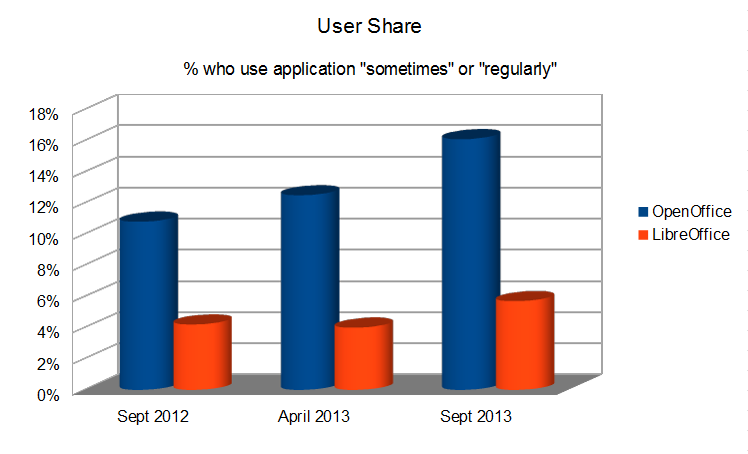

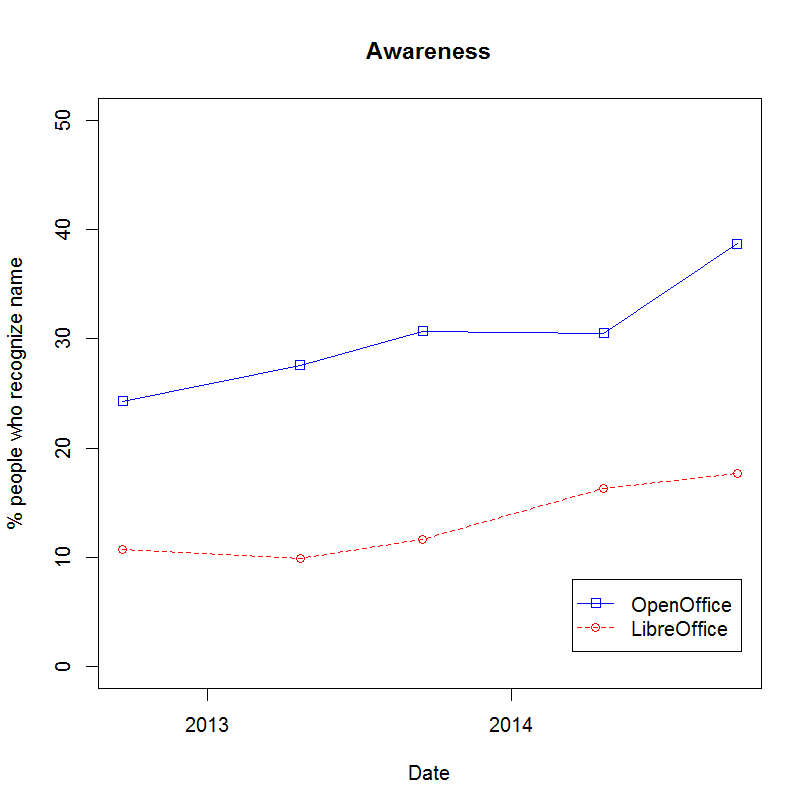

Those who know me know that I am partial to OpenOffice, an open source project that I contribute to. So I am extremely pleased to see it continue to advance in all fronts. Since coming to Apache, OpenOffice’s name recognition has grown from 24% to 39% and the user share has grown from 11% to 18%, while keeping user satisfaction constant. This is a testament to the hard work of the many talented volunteers at Apache.

Those who know me know that I am partial to OpenOffice, an open source project that I contribute to. So I am extremely pleased to see it continue to advance in all fronts. Since coming to Apache, OpenOffice’s name recognition has grown from 24% to 39% and the user share has grown from 11% to 18%, while keeping user satisfaction constant. This is a testament to the hard work of the many talented volunteers at Apache.